Paycheck take home calculator

Overview of Georgia Taxes Georgia has a progressive income tax system. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

We used a paycheck calculator to find out take-home pay for a 100000 salary in the largest US cities based on 2020 tax rates.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Calculate your take home pay after federal Oregon taxes deductions and exemptions. This calculator is intended for use by US. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option.

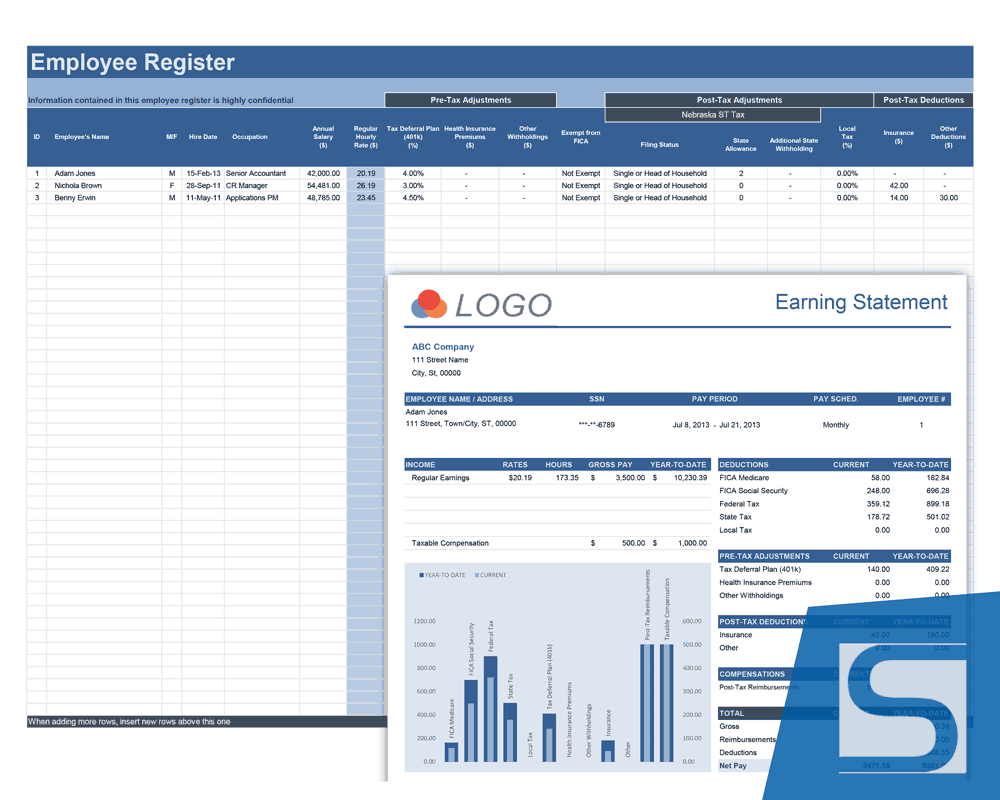

This payroll tool is easy and helpful for small business owners. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to hourly calculator. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. For annual and hourly wages. It can also be used to help fill steps 3 and 4 of a W-4 form.

Then enter the number of hours worked and the employees hourly rate. Experiment with the paycheck calculator above to answer these questions among others while also pinpointing any changes you can make to boost your take. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

We used SmartAssets paycheck calculator to find out how much. Switch to salary calculator. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll.

You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. SurePayrolls Salary Paycheck Calculator generates take-home pay for salaried employees. Calculating paychecks and need some help.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Salary Paycheck and Payroll Calculator.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions. Skip To The Main Content.

Hourly Paycheck Calculator Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. Oregon Paycheck Calculator Calculate your take home pay after federal Oregon taxes Updated for 2022 tax year on Aug 02 2022. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 2022 state and local income tax rates.

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Take Home Salary Calculator India 2021 22 Excel Download

How To Calculate Net Pay Step By Step Example

Payroll Calculator With Pay Stubs For Excel

Hourly To Salary Calculator

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll For Hourly Employees Sling

Here S How Much Money You Take Home From A 75 000 Salary

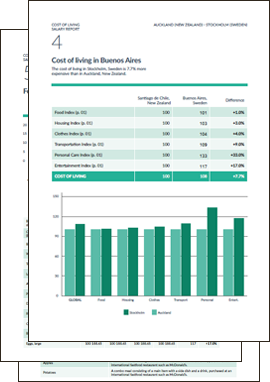

International Salary Calculator Calculate The Salary You Will Need

4 Ways To Calculate Annual Salary Wikihow

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator With Pay Stubs For Excel

Salary Formula Calculate Salary Calculator Excel Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

Net Pay Calculator Store 58 Off Www Wtashows Com

Salary Formula Calculate Salary Calculator Excel Template